BIN Lookup

BIN Lookup

Let’s find the BIN on your credit card.

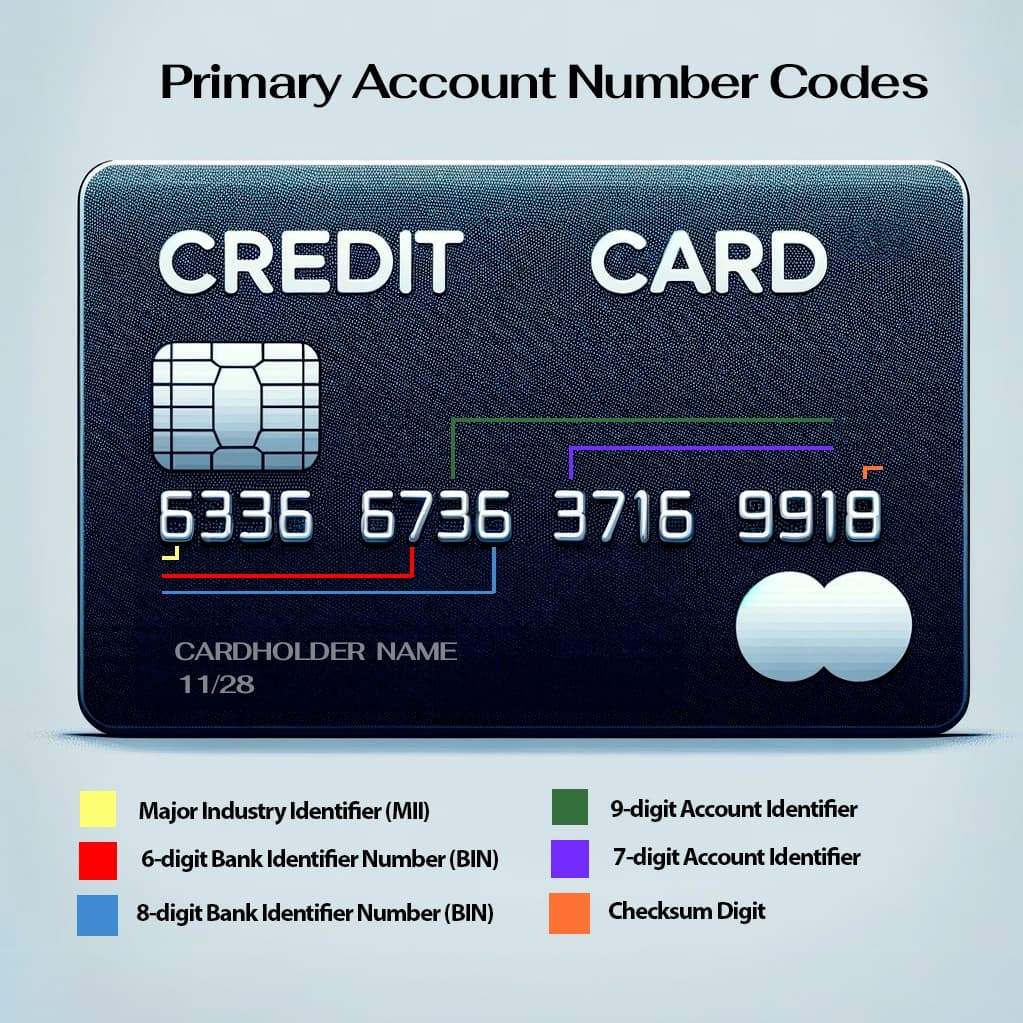

The 16-digit account number on your credit or debit card is called the Primary Account Number (PAN). This number tells a story which includes the Bank Identification Number (BIN).

The Primary Account Number has three overlapping parts:

- The Bank Identification Number (BIN or IIN)

- The Account Identifier

- The Checksum Digit

Within each part are significant digits with special meaning.

The Major Industry Identifier (MII)

The first digit of the BIN is the Major Industry Identifier (MII). Common MII numerical identifications include:

0: ISO/TC 68 and Other Industry Assignments

1 and 2: Airlines

3: Travel and Entertainment

4 and 5: Banking and Financial Institutions

6: Merchandising and Banking

7: Petroleum and Other Future Industry Assignments

8: Healthcare, Telecommunications, and Other Future Industry Assignments

9: Future National Assignment

The Account Identifier

The Account Identifier links the physical card to your account for properly routing and posting all transactions.

Since the BIN takes up 6-8 digits, the Account Identifier begins after the last digit of the BIN and extends to the penultimate digit. It is, therefore, either seven or nine digits long.

The Checksum Digit

The last digit in the PAN is the Checksum Digit. This number is calculated using the Luhn algorithm, a checksum formula that validates a variety of identification numbers.

The purpose of this number is to protect against accidental errors, such as a mistyped digit.

BIN Number Lookup

It’s time to learn what the BIN itself can tell you.

Using our BIN Number Lookup tool, you can find a great deal of information.

Here's the list:

- Issuing Bank or Institution: Essential for routing transactions to the correct bank for authorisation and settlement.

- Card Network: Indicates the card network, like Visa, MasterCard, American Express, and Discover. Each card network has specific BIN ranges assigned to it.

- Card Type: Credit, debit, charge, or prepaid card.

- Card Level: Standard, gold, platinum, corporate, or other special categories relating to the benefits or credit limits associated with the card.

- Geographic Location: Useful in detecting transactions that may be unusual for the cardholder’s typical activity.

- Fraud Prevention: By analysing the BIN, merchants and financial institutions can apply appropriate risk measures.

- Regulatory Compliance: For transactions that cross international borders, the BIN helps in adhering to the respective financial regulations of the countries involved.

- Merchant Category Identification: This can help in identifying the category of merchants where the card may be or is often used.

Content by Don Hamilton - usefulwriter.com